Favorite Info About How To Increase Federal Withholding

If your employer suspended payroll taxes in 2020, it must collect the deferred taxes from your paycheck by december 31, 2021.

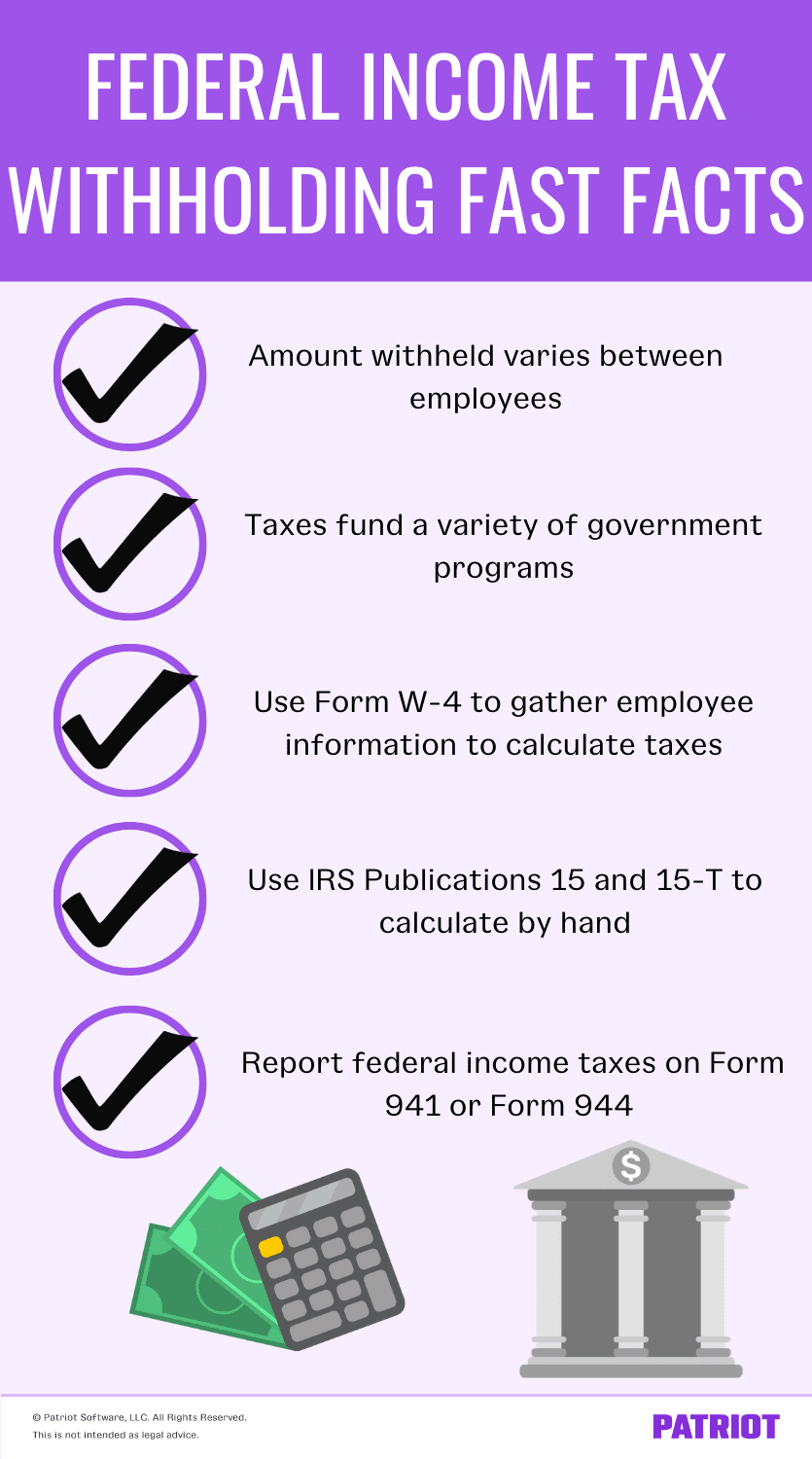

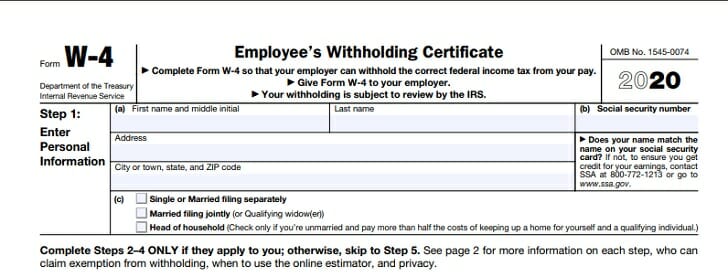

How to increase federal withholding. That’s as easy as preparing a form w. If you’re already receiving benefits, you’ll have to ask social security to start withholding taxes. One way to adjust your withholding is to prepare a projected tax return for the year.

If you get social security, you can ask us to withhold funds from your benefit and we will credit them toward your federal taxes. To change your tax withholding amount: Changing your federal income tax withholding (fitw) your circumstances may change and these may have an effect on your tax liability.

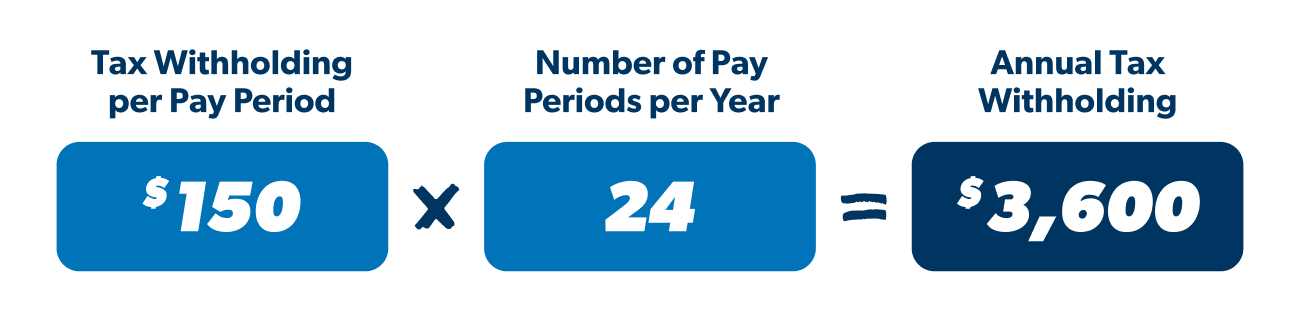

If you find yourself in a situation where you owe more this year than you expected, try increasing your withholding on your tsp withdrawals. Citizens, resident aliens, or their estates who are recipients of pensions, annuities, and certain. An employee can request an additional amount to be withheld from each paycheck.

You can do this by completing step 1 on. From the employees menu select the employee center. To help taxpayers who want to change this amount, the withholding calculator will offer recommendations for adjusting withholding.

The amount of income tax your employer withholds from your regular pay. Or keep the same amount. To change your tax withholding, use the results from the withholding estimator to determine if you should:

When this happens, you can adjust. Use the same tax forms you used the previous year, but substitute this year's tax rates. (if you are deaf or hard of hearing, call the irs tty number, 1.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)