Nice Info About How To Buy Down A Mortgage Rate

And if that happens, borrowing rates for mortgages might start to.

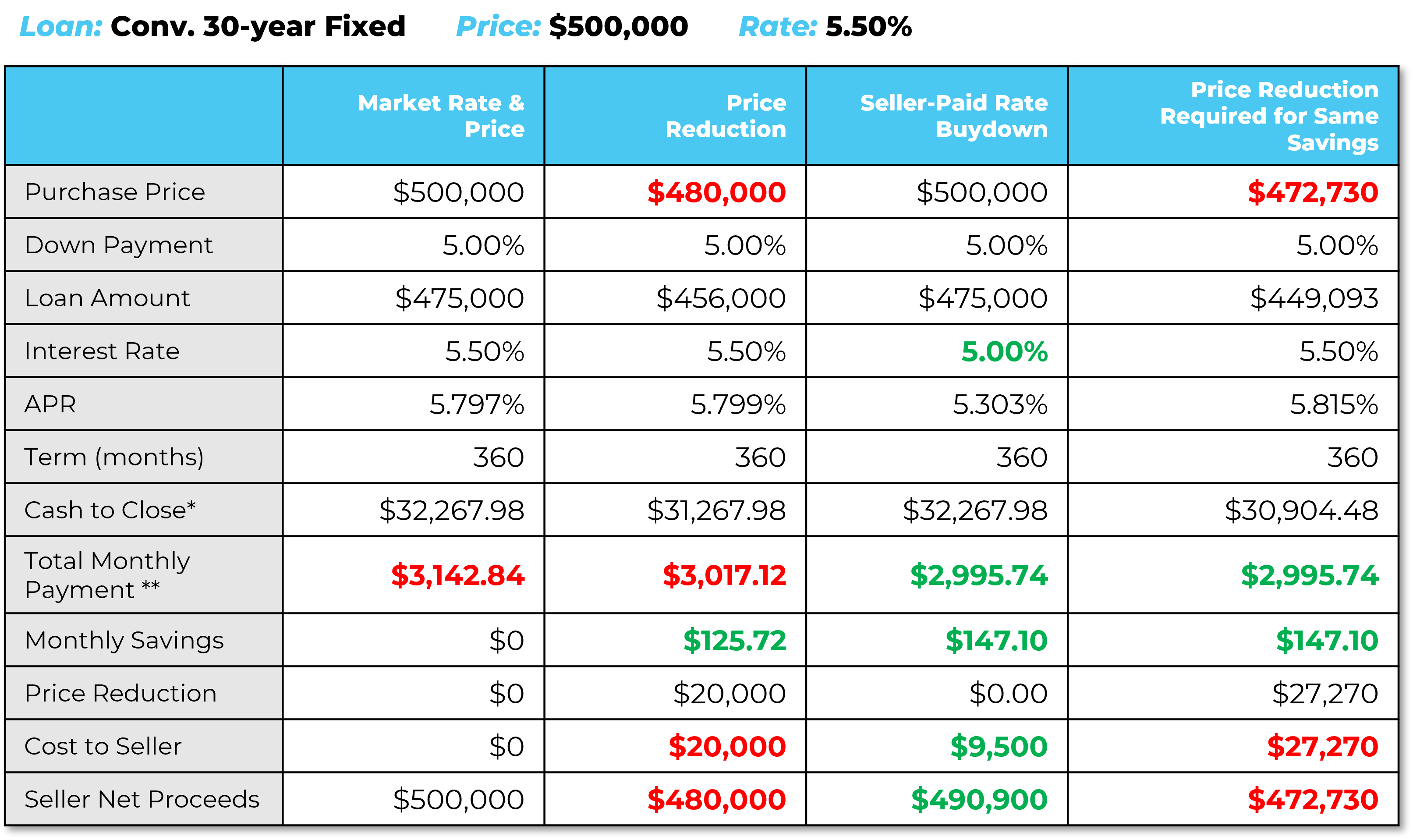

How to buy down a mortgage rate. The easiest way to buy down your mortgage rate is to buy discount points. For example, if you wanted to borrow $400,000 at 6%, but you bought a mortgage point, you’d. Calculate monthly mortgage by completing lender application & see how much you can afford.

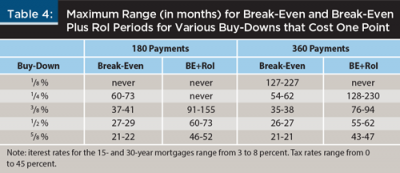

Borrowers can essentially buy a lower interest rate upfront. Those who were fortunate enough to land a historically low rate in 2021 made out well. Typically each point costs 1% of the loan and lowers your mortgage rate by.25%.

Now is the time to take action and lock your rate! 5 ways millennial homebuying differs from other generations. A mortgage point is equal to 1 percent of your total loan amount.

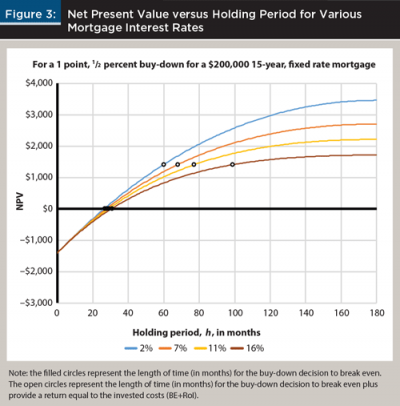

Ad we're america's #1 online lender. Determine how many discount points you are willing to spend to buy down your rate. Discount points, or mortgage points, are a kind of prepaid interest that you pay in exchange for a lower rate and monthly payments;.

Consent may also be revoked at any time by emailing [email protected] or by contacting your. You can cover the cost yourself, ask the seller to pay for it or finance it into your. A homeowner or buyer can determine the cost to buy down to a specific rate by taking the lender's discount points quote and multiplying the points as a percentage times the loan amount.

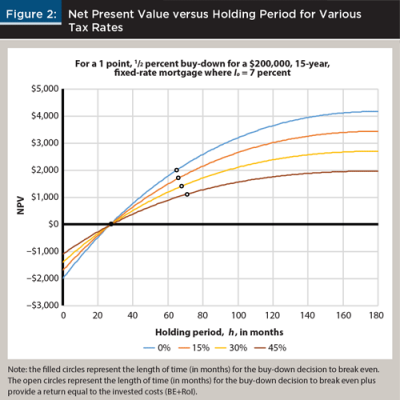

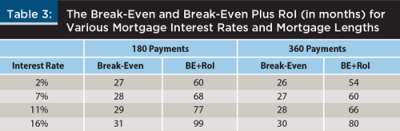

Assuming that same $85,000 down payment and a $2,000 monthly mortgage payment. The first year of your loan you save $257.12 on your monthly payment at a 5.5%. One of the best ways to score a lower mortgage rate is to convince lenders that you’re a highly qualified borrower who won’t have any trouble making your mortgage payments.

:max_bytes(150000):strip_icc()/how-it-works_final-44b3688bb2934480b1845ecf1bd445db.png)