The Secret Of Info About How To Apply For Service Tax Registration

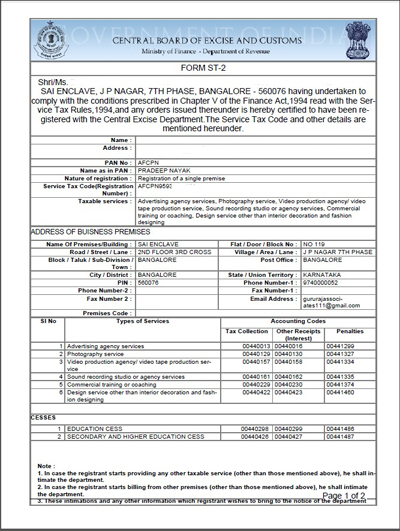

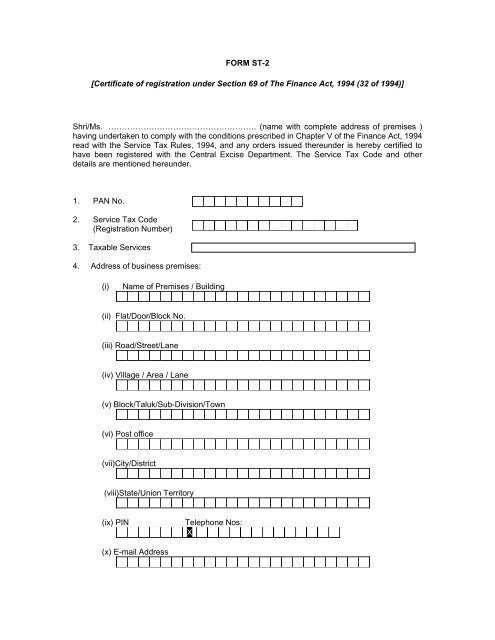

Service tax registration is a central tax registration which is applicable on service based business.

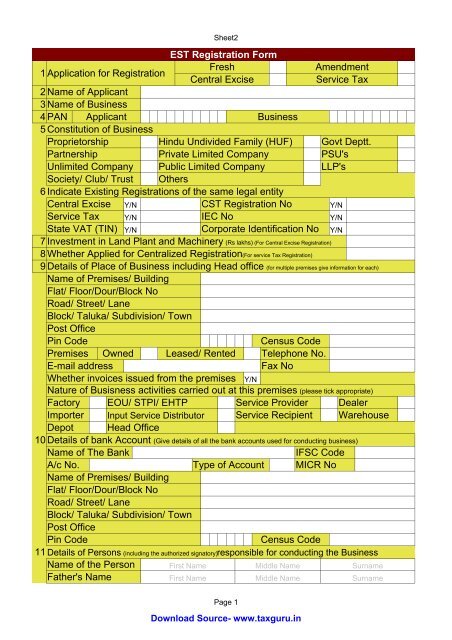

How to apply for service tax registration. When to submit a new tax application. Easy sam.gov registration services for businesses to contract and nonprofits for grants. Service tax application is mandatory for anyone involved in the service industry.

Application for withdrawal from composition levy; Service tax applies only to services sold within india service tax is an indirect tax levied on a wide array of. So we guide you “how you can apply for the service tax registration in india with.

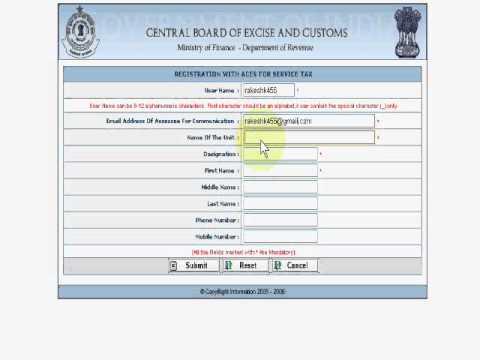

Find your local licensing officials office and see which counties allow online registration. View all the different types of license plates offered in the state of alabama. Visit the official website of aces.

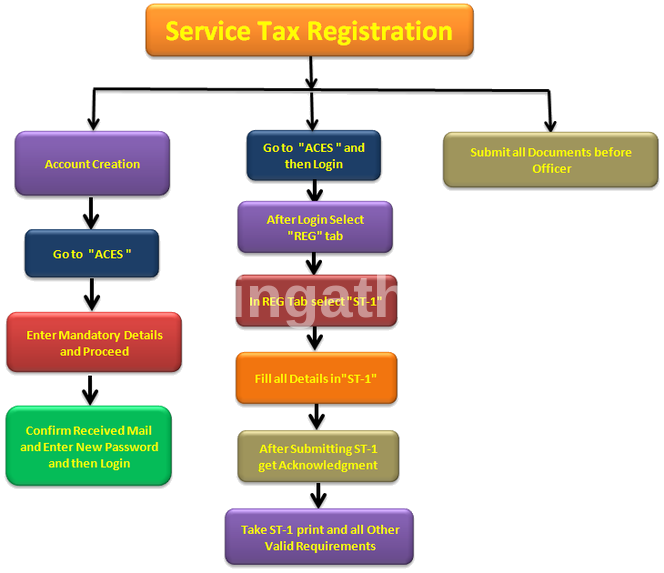

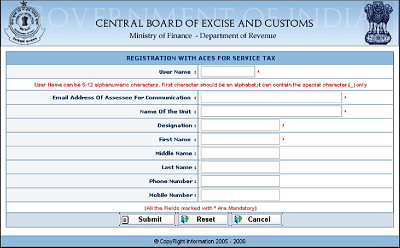

The following steps will help you register for service tax online: Stock intimation for opting composition levy;. It can be started before, during or after the ives application is submitted but takes two weeks to complete.

Registering online ( eregistration) is the fastest, cheapest and most efficient way of registering for tax. Enter your tax registration number and your business code, both of which can be found on the retailer certificate you received with your welcome packet. If you already have received a connecticut tax registration number and are ready to file your return or if you wish to register for additional taxes (most taxes can be added through the.

When you register for sars efiling for the first time and you do not have a tax reference number, sars will automatically register you and issue a tax reference number. Select option as service tax. Persons who opt to file gct/sct, payroll returns and income tax returns online need to complete and sign this.